Managing healthcare expenses can be a hassle, but digital tools are making it easier. While PhonePe is famous for UPI payments, many users don’t realize they can also use it to manage their Flexible Spending Account (FSA) debit cards for eligible medical purchases.

This guide explores how to add your FSA card to PhonePe, best practices for seamless payments, and what to do if your card is declined.

1. Can You Add an FSA Card to PhonePe?

Yes, but with specific conditions. FSA cardsfunction like standard debit cards on networks like Visa or Mastercard. However, because they are funded with pre-tax dollars for specific uses, they cannot be used for standard UPI transfers (person-to-person).

Instead, you can add them as a saved card for merchant payments at pharmacies, hospitals, and diagnostic centers.

2. How to Add Your FSA Card to PhonePe

Follow these steps to store your card for quick access:

- Open Profile: Tap your profile picture in the top-left corner of the PhonePe App.

- Payment Methods: Scroll to the Payment Methods section and select View All.

- Manage Cards: Select Credit/Debit Cardsand tap Add New Card.

- Enter Details: Manually enter your 16-digit FSA card number, expiry date, and CVV.

- Verify: PhonePe will perform a small verification transaction (usually ₹2, which is refunded). You will need to enter the OTPsent to the mobile number registered with your FSA provider.

3. Optimized Practices for Smooth Payments

To ensure your healthcare payments aren’t blocked, follow these industry best practices:

- Check Merchant Eligibility: FSA cards only work at merchants with an approved Merchant Category Code (MCC), such as pharmacies or doctors’ offices. A generic grocery store payment will likely be declined even if you’re buying medicine.

- Activate Your Card First: Ensure your physical card is activated on your provider’s portal (e.g., Optum Bank or HealthEquity) before adding it to PhonePe.

- Keep Your Receipts: Even if a digital payment is successful, your FSA administrator may require a photo of the itemized receipt for compliance.

- Use for Premiums: You can often use PhonePe to pay Health Insurance premiums directly using saved cards.

4. Limitations to Keep in Mind

- No P2P Transfers: You cannot send money from an FSA card to a friend or family member via UPI.

- International Use: If your FSA is from a non-Indian provider (like a US-based employer), it may not work for domestic Indian merchants due to cross-border restrictions on most healthcare cards.

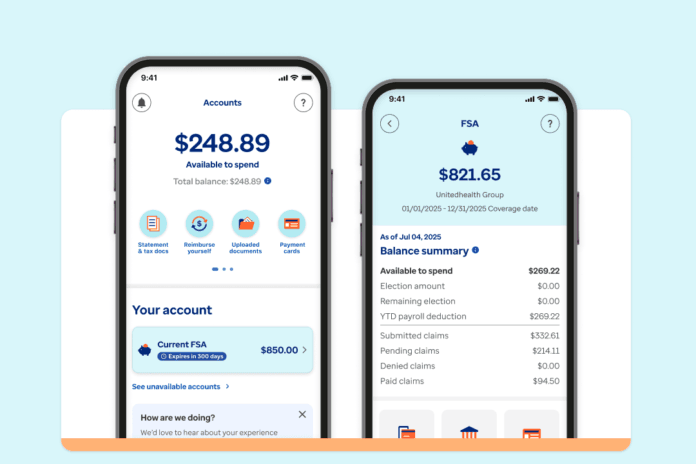

- Balance Monitoring: PhonePe cannot show your live FSA balance. Use your provider’s official app (e.g., NIHP FSA) to check funds before swiping.

5. Troubleshooting: What if the Card is Declined?

If your FSA card is declined on PhonePe:

- Verify the Merchant: Ensure they are a recognized healthcare provider.

- Check the Balance: Ensure you have enough funds for the total transaction.

- Manual Reimbursement: If digital payment fails, pay with a personal card and file a reimbursement claim through your FSA provider’s website or app by uploading the receipt.

In 2026, most major Indian healthcare providers have fully integrated digital payments into their checkout processes. If you have saved your FSA card in PhonePe, you can use it at the following categories of merchants.

National Pharmacy Chains

These retail giants accept digital wallet payments and saved cards at their physical billing counters and on their mobile apps.

- Apollo Pharmacy: Accepts major digital wallets including PhonePe, credit/debit cards, and UPI for medicine purchases across its extensive network.

- MedPlus: One of India’s largest pharmacy retailers with over 4,000 stores; they accept PhonePe and other card payments at all retail outlets.

- Netmeds: Supports various digital wallet options and card payments via their app and online portal.

- Tata 1mg: Offers multiple digital payment methods including Amazon Pay, Airtel Payments Bank, and saved cards.

Diagnostic & Laboratory Centers

Diagnostic centers across India now provide multiple digital transaction options for lab tests and screenings.

- Orange Health: Specializes in at-home sample collection with payment options via digital wallets and cards.

- Diagnopein Diagnostic Centre (Mumbai):Offers pathology and radiology services; explicitly accepts Google Pay, NFC mobile payments, and standard credit/debit cards.

- Micropath Laboratory (Assam): A NABL-accredited facility that supports PhonePe, G Pay, and UPI for all diagnostic services.

- Practo / Lybrate: These online consultation platforms allow you to book and pay for diagnostic tests using stored wallet cards.

Hospital Systems

Large hospital groups in 2026 utilize hybrid payment platforms like SabPaisa to support omnichannel transactions (UPI, cards, and wallets).

- Apollo Hospitals: Accepts digital wallet payments for OPD services, IPD billing, and pharmacy at their hospital counters.

- Max Healthcare & Medanta: These major chains have upgraded their billing infrastructure to support seamless “tap and pay” and digital wallet transactions for medical tourism and local patients.

- Government Facilities (Jan Aushadhi):Many government-run healthcare centers, including Jan Aushadhi and AYUSH centres, now accept digital payments to align with the Digital India initiative.

Digital Health Platforms

PharmEasy: A major e-pharmacy and diagnostic aggregator that supports payments via PhonePe and other digital wallets

Mfine: Provides online consultations and at-home lab tests with integrated digital payment gateways.